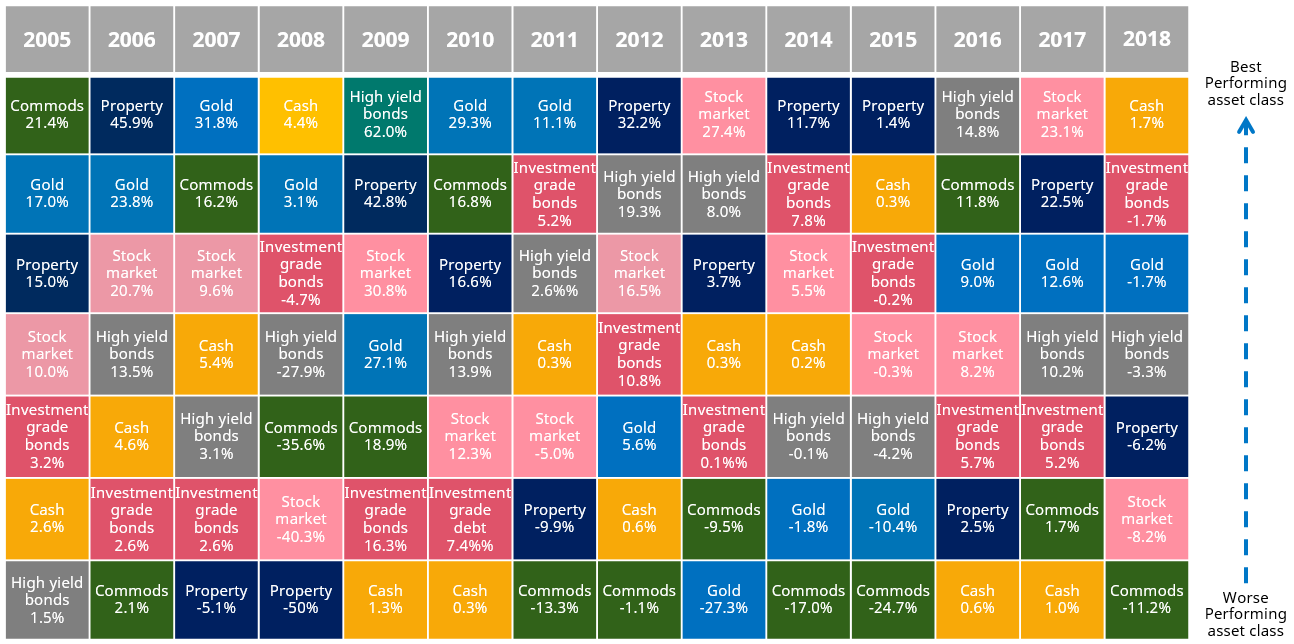

The graphic shows the best and worst performing assets each year since 2005. Schroders research illustrates why diversifying your investments matters, explains David Brett, Investment Writer at Schroders.

The temptation among investors is to stick to what you know. That is no bad thing. It is a strategy championed by successful investment pioneers such as Warren Buffett, a famous devotee of stocks.

It can work, when the market is rising and you have picked the right asset. However, it’s also important for investors to consider the merits of diversification.

This table underlines the importance of spreading your money around. It can potentially help reduce risk and maybe even improve the long-term performance of your overall portfolio. It shows the returns achieved by some of the main asset classes in each year.

Of course it’s important to note that past performance is not a guide to future performance and may not be repeated.

Stock market performance is measured by the MSCI World Total Return index. Investment grade bonds relates to global government and corporate bonds deemed to be at relatively low risk of default. Property relates to the returns from global real estate markets as measured by Thomson Reuters. More detail on the indices used for each asset can be found at the foot of the table.

Asset class performances 2005-2018

Past performance is not a guide to future performance and may not be repeated. Source: Schroders, Refinitiv data correct as of 01 January 2019. Stock Market: MSCI World Total Return Index, Property: Thomson Reuters Developed Market Real Estate Total Return Index. Cash: IBA US dollar interbank LIBOR 3 month, High Yield Bonds: BofA Merrill Lynch Global High Yield TR Index, Investment Grade Bonds: ICE BofAML Global Corporate Total Return Index, Commods: Bloomberg Commodity Index, Gold: Gold Bullion LBM $/t oz. All show total return in local currency.

Past performance is not a guide to future performance and may not be repeated. Source: Schroders, Refinitiv data correct as of 01 January 2019. Stock Market: MSCI World Total Return Index, Property: Thomson Reuters Developed Market Real Estate Total Return Index. Cash: IBA US dollar interbank LIBOR 3 month, High Yield Bonds: BofA Merrill Lynch Global High Yield TR Index, Investment Grade Bonds: ICE BofAML Global Corporate Total Return Index, Commods: Bloomberg Commodity Index, Gold: Gold Bullion LBM $/t oz. All show total return in local currency.

What are the benefits of diversification?

The tables reflects how the fortunes of assets often diverge.

Consider the example of gold. It is often described as the ultimate diversifier because it tends to be uncorrelated with the movement of other assets. In particular, it is perceived as being an asset to hold during times of uncertainty. In 2011, stock markets lost 5% amid the uncertainty of the European debt crisis. But investors who held some money in gold will have had their losses eased thanks to an 11% return for that asset.

The benefits of diversification can be described in various ways:

Managing risk: A crucial imperative for investors is not to lose money. There is risk with every investment – the risk that you receive back less than you put in or the probability that it will deliver less than you had expected. This risk varies by the type of investment. Holding different assets mean this risk can be spread. It could also be managed by you or by a professional, such as financial adviser. Specialist fund managers can also allocate money to help manage risks.

Retaining better access to your money: The ease with which you can enter or exit an investment is important. Selling property can take a long time compared with selling equities, for example. Holding different types of investment that vary in terms of “liquidity” (the ease of buying and selling) means you can still sell some of your investments should you suddenly need money.

Smoothing the ups and downs: The frequency and magnitude by which your investments rise and fall determines your portfolio’s volatility. Diversifying your investments can give you a greater chance of smoothing out those peaks and troughs.

Johanna Kyrklund, Global Head of Multi-Asset Investments at Schroders, said: “For me, the merits of diversification cannot be emphasised strongly enough. I’ve been a multi-asset investor for more than 20 years and have inevitably faced some pretty turbulent spells for markets. Each time, the ability to nimbly move between different types of assets has better equipped me to navigate those periods.

“Diversification, if carefully and constantly managed, can potentially deliver smoother returns; it’s a key tool to help in balancing the returns achieved versus the risks taken.”

Too much diversification?

There is no fixed rule as to how many assets a diversified portfolio should hold: too few can add risk, but so can holding too many.

Hundreds of holdings across many different types of investment can be hard for an individual investor to manage.

What has been the best and worst performing assets since 2005?

Gold was the best performing asset, bolstering its reputation as a safe haven during times of uncertainty. It’s worth noting that much of the gains were made in the early part of that period before the uncertainty of the financial crisis took hold.

Gold’s strong performance is all the more noteworthy when commodities were found to be the worst performing asset over the 14 years. They alone of the six assets would have lost investors money.

In real terms, $1,000 invested in gold in 2005 would now be worth $2,925 – an 8.3% annual return. $1,000 invested in commodities would now be worth $630 – representing a 2.3% annual loss.

This article has first been published on schroders.com.