The divergence between growth and value parts of the market has been extreme and could be due a turnaround, argues Rory Bateman, Head of Equities at Schroders.

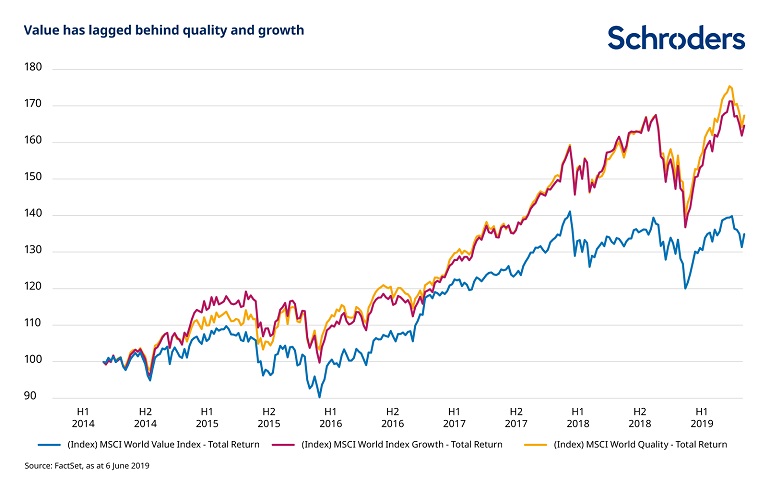

The outperformance of “growth” and “quality” style stocks versus “value” has been a defining feature of markets in recent years. This outperformance was very marked in 2018 and at the start of 2019. In many ways this is to be expected as we move towards the end of this economic cycle.

Value stocks tend to be more tied to the economic cycle and so their earnings are less predictable, especially as the world economy slows. By contrast, growth stocks generally have more visible earnings and the market so far has still been willing to pay up for this in the form of ever-higher share prices.

Given how long this economic cycle has been going on for, growth’s continued outperformance is perhaps unsurprising, as investors wonder if the economy is due a turn for the worse.

However, we think there are other factors at play too. Equity (stock) markets have seen huge inflows of passive money over the last few years. This passive money is essentially forming what is known as a “momentum trade”, meaning the money goes towards those companies that have already performed well and so form a larger weighting of a given index. This momentum trade could become quite worrying in the medium term as money continues to flow into stocks with little regard to their underlying fundamentals.

Despite their more volatile earnings profile, we may be close to the point where value stocks are simply so cheap that they can no longer be ignored. When we reach that point, value should start to perform better.

What value stocks need is for investors to look through the end of this economic cycle. Once we’ve seen clear evidence of slowdown in the underlying economy, investors will start to look towards the next earnings recovery. That’s when the value element of the stock market could really start to recover.

This divergence of value compared to growth and quality is significant in every market in the world, although it’s most acute in Europe. Globally, quality has outperformed value by nearly 5% p.a. over the last five years, so we are at extreme levels in terms of the valuation differential.

This extreme outperformance means growth stocks could look very vulnerable if we were to see a “risk-off” environment. This is where nervy investors shy away from higher risk assets such as equities and move instead towards the relative safety of bonds, for example. We think this risk-off trade would likely be most evident in these highly-rated quality and growth stocks, particularly if these companies were to start missing their earnings forecasts.

Such a risk-off environment would clearly be negative for the overall equity market. But we think the elevated valuations of quality and growth mean these areas could be the most negatively affected, and value could perform better on a relative basis.

This article has first been published on schroders.com.