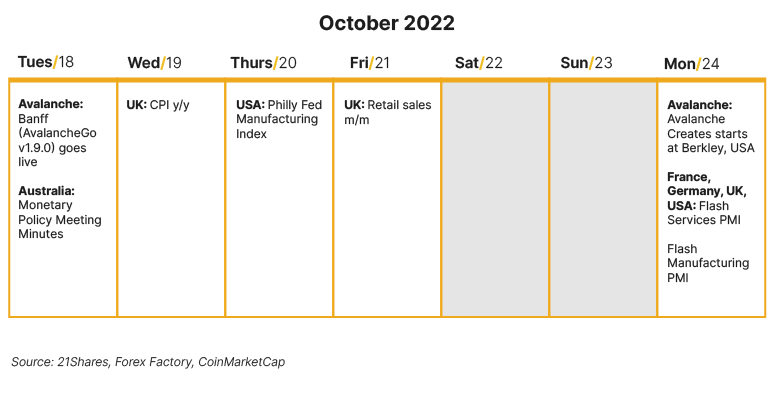

| Markets have struggled over the past week on the back of inflation pressures sandwiched by the burgeoning war in Europe and the COVID-zero measures in China, adding flame to the fires of both crises of energy and supply. Returns on Bitcoin and Ethereum have been persevering, increasing by almost 3% and 4% respectively over the past week. The biggest headline was the $114M exploit on Solana’s Mango Market that dragged its total value locked (TVL) down by over 20%, as shown in Figure 1; the attacker later revealed himself, claiming that he is part of a group of investors that benefited from the “highly profitable trading strategy” and that their actions were legal open market actions. Aside from that, the biggest losers within major crypto categories were Cardano and Optimism, whose TVLs declined by -8%. Ethereum’s largest decentralized exchange increased by 7% and its TVL declined by almost 9%. Uniswap Labs’ $165M Series B round raised last week is expected to improve user experience and in turn boost performance.

Figure 1: TVL and price development of major crypto sectors |

|

| Source: 21Shares, Coingecko, DeFi Llama

Key takeaways:

|

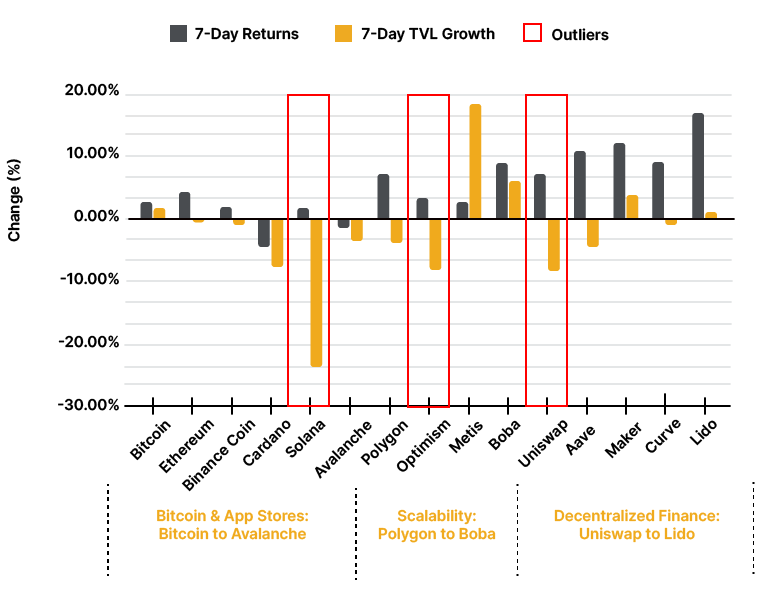

Spot and Derivatives MarketsFigure 2: |

|

| Source: Bitcoin Magazine Pro

BTC-denominated open interest reached an ATH relative to the asset’s market cap, which could signal a breakout move to either side. However, as Bitcoin’s funding rate has been range-bounding near the neutral territory since June, it’s becoming difficult to gauge market sentiment as this tight range signifies that a roughly growing equal number of longs and shorts are being placed. Bitcoin’s dampening volatility has caused the asset to undergo moderate swings between the 18K-20.5K levels. That said, with BTC’s volatility at an ATL that hasn’t been seen since 2020, a hot CPI print in November could bring about a tense move for the asset On-chain IndicatorsFigure 3: |

|

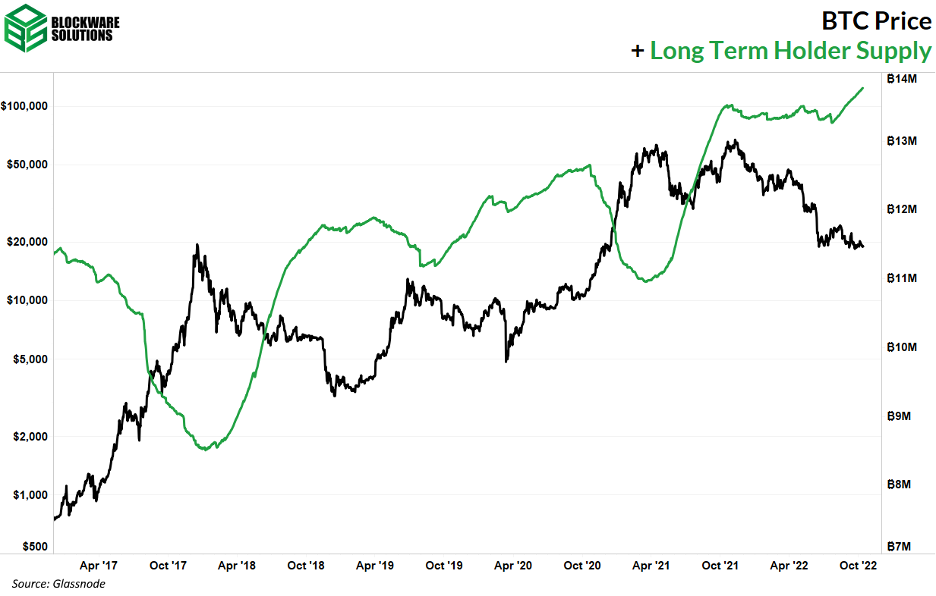

| Source: Glassnode, Blockware Solutions

As shown in Figure 3, the total supply in the hands of long-term Bitcoin holders has reached a new all-time high of over 13.5M Bitcoins. This reiterates the conviction that the value of Bitcoin lies in its long-term investment, given that long-term holders are the winners of Bitcoin’s rally. |

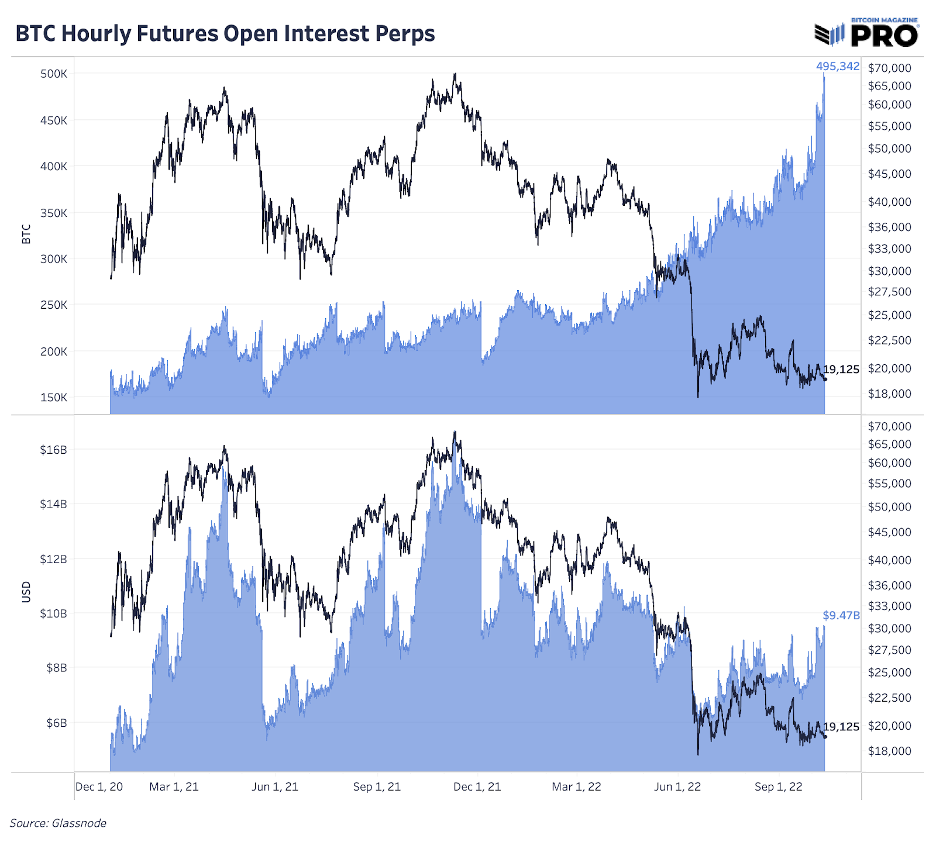

Next Week’s Calendar |