Humans have consumed a year’s worth of natural resources in less than seven months, explains Pictet Asset Management. Our model quantifies the environmental impact of over-consumption.

July 29 is the date everyone should mark in their diary in 2019.

That’s because it is Earth Overshoot Day, the day when humans will have used up a year’s worth of the planet’s natural resources, such as timber, fish, water, and minerals.

For the rest of the year, we will be drawing down on what will be available for future generations – using more than the Earth can naturally replenish in a 12-month period – and producing waste such as carbon dioxide emissions as we do so.

What is worrying is that Overshoot Day, calculated by non-profit organisation Global Footprint Network (GFN), has fallen earlier every year since the start of the 1970s.

Pictet Asset Management’s research paints a similarly alarming picture. It shows that human activity, and the waste it generates, is leading to potentially irreversible changes to the planet’s ecosystem.

Our analysis, which is based on a bio-capacity measurement tool called the Planetary Boundaries (PB) framework, quantifies resource consumption and waste emissions across each of the 100-plus industries that make up the global economy.

Developed by the Stockholm Resilience Centre, the model assesses the state of the ecosystem along nine environmental dimensions – which include water use, land use and ozone depletion among others – to set the ecological “safe operating space” within which human activities should take place.

Already, five of those thresholds have been breached.

Take the biochemical flow of nitrogen and phosphorus for example.

Nitrogen and phosphorus are macronutrients that are used extensively in fertilisers. Intensive farming, industrial activity and population growth have increased the volume of macronutrients in rivers and oceans to dangerous levels, triggering excessive growth of algae.

This is a problem because algae deplete oxygen in water, killing aquatic plants and fish in a process called eutrophication. Scientists estimate that sea areas with zero oxygen, or “dead zones”, have quadrupled since 1950s, threatening marine ecosystems around the world1.

Our industry level analysis shows biochemical waste is being released at a rate that is 40 per cent more than the environment can handle.

However, it’s not all doom and gloom.

There are signs that efforts to stop environmental damage – be it policy measures or new innovative technologies to address ecological degradation – are starting to pay off.

According to GFN, throughout the 1970s to 2014, Overshoot Day fell earlier each year by an average of three days. Since then, however, the pace has slowed to less than a day per year.

Our model also gives reason for optimism. It shows that some of the industries serving forestry and other environmental sectors are managing to reduce the amount of biochemical waste they produce, aided by innovative technologies in areas such as pollution-control.

These companies play an important role in helping us pay our environmental “debt” and live within our means.

Investing to mitigate biochemical pollution

The PB-LCA framework is used in the construction of our Pictet-Global Environmental Opportunities (GEO) portfolio.

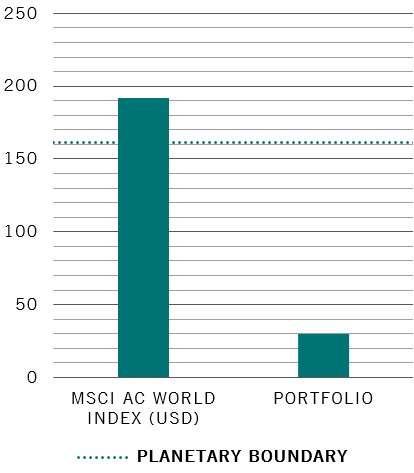

Stocks in GEO have a significantly lower biochemical footprint than those represented in the MSCI All-Country World equity index.

MAKING AN IMPACT

Biochemical flows per year in kg, nitrogen-equivalent, per USD million of annual revenue Source: Pictet Asset Management, data as of 31.12.2018

Source: Pictet Asset Management, data as of 31.12.2018

Here’s how Pictet-Global Environmental Opportunities strategy works:

- The strategy invests in the shares of companies within a thriving environmental industry that are making an active contribution to safeguarding the world’s natural resources.

- Investments are chosen from a broader universe consisting of the world’s 3,500 most environmentally-responsible publicly-held firms – companies that meet the criteria of our proprietary PB-LCA framework.

- The strategy is a concentrated portfolio of 50 to 60 stocks, operating in fields such as pollution control, water supply, renewable energy, waste management and sustainable agriculture.

- With a risk-return profile similar to that of a growth-oriented investment strategy, Pictet AM’s Global Environmental Opportunities can be used to complement an equity allocation within a global portfolio.

1) https://science.sciencemag.org/content/359/6371/eaam7240

Please find a German version of this article here: Leben auf Pump: Erdüberlastungstag

Über Pictet Asset Management

Pictet Asset Management ist ein unabhängiger Vermögensverwalter mit einem verwalteten Vermögen von 165 Milliarden EUR, das wir für unsere Kunden in Aktien, Festverzinsliche, alternative Anlagen und Multi-Asset-Produkte investieren. Wir verwalten Einzelmandate und Anlagefonds für einige der größten Pensionsfonds, Finanzinstitute, Staatsfonds, Finanzintermediäre und deren Kunden weltweit. Bei unserem auf Anlagen basierenden Geschäft verfolgen wir einen langfristigen Ansatz mit einer einzigartigen Kundenorientierung. Unser Ziel ist es, der bevorzugte Anlagepartner unserer Kunden zu sein. Wir schenken ihnen unsere ungeteilte Aufmerksamkeit, bieten Pionier-Strategien und fühlen uns der Exzellenz verpflichtet.

Mehr zu den Anlagestrategien von Pictet Asset Management

Folgen Sie Pictet Asset Management

Für weitere Informationen steht Ihnen Frank Böhmer gerne zur Verfügung.

Telefon: 069-79 5009 1224

e-mail: fbohmer@pictet.com